With the strength of the current housing market growing every day and more Americans returning to work, we are experiencing a faster-than-expected recovery in the housing market. The recovery is already well underway. Regardless, many people are still asking the question: will we see a wave of foreclosures as a result of the current crisis? Thankfully, research shows the number of foreclosures is expected to be much lower than what the US economy experienced during the last recession. Here’s why.

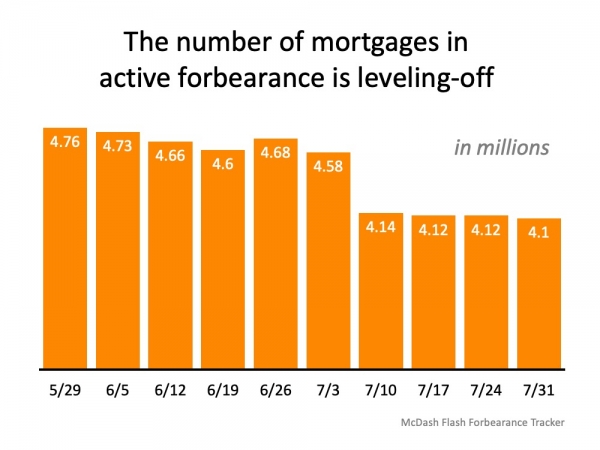

According to Black Knight Inc., the number of those in active forbearance has been leveling-off over the past month (see graph below):

Forbearance is when you and your mortgage lender agrees to temporarily adjust or even suspend your payments for a short period while you are dealing with a financial challenge keeping you from making your monthly mortgage payment. Typically the missed payments (principal and interest) are added to the back end of your loan term. In essence you extend your mortgage beyond the agreed length to allow you to pay the missed payments later. The downside is that you then have additional interest to be paid on your loan so this will ultimately cost you more to own your home outright.

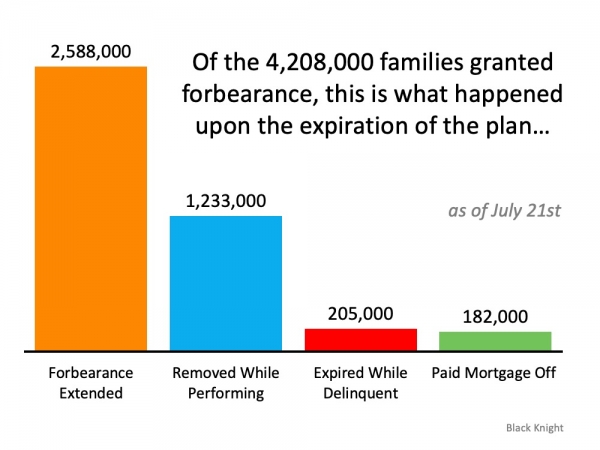

Black Knight Inc. also notes, of the original 4,208,000 families granted forbearance, only 2,588,000 of these homeowners got an extension. This means that 62% of people who applied for forbearance were able to negotiate a mortgage extension with their lender. Many homeowners have once again started to pay their mortgages, paid off their homes, or never even went delinquent on their payments in the first place. They may have applied for forbearance out of precaution, but never fully acted on it (see graph below):

The housing market, and homeowners, therefore, are in a much better position than what a lot of the reports are saying. The reason for this good position has a lot to do with the fact that today’s homeowners have more equity than the general public realizes. According to John Burns Consulting, over 42% of homes are owned free and clear, meaning they are not tied to a mortgage. Of the remaining 58%, the average homeowner has $177,000 in equity. That number is helping many homeowners stay in a strong financial position today giving them options to avoid foreclosure.

ATTOM Data Solutions collects information on the real estate and property market. Their recent data indicates that there is a potential for the number of foreclosures to significantly increase throughout the country in the coming year, but it is very important to understand the reasons why foreclosures probably won’t rock the housing market this time around:

“The United States faces a possible foreclosure surge over the coming months that could more than double the number of households threatened with eviction for not paying their mortgages.”

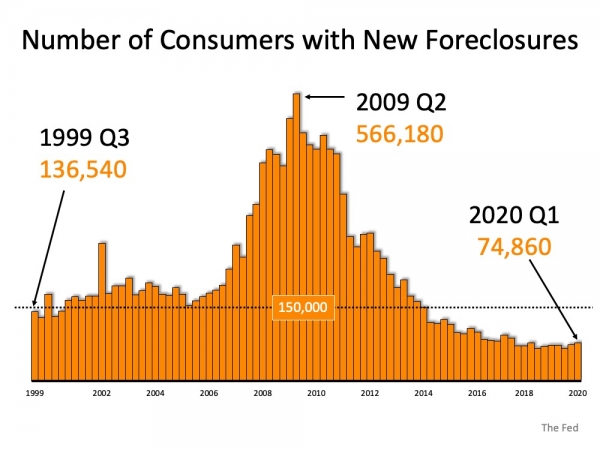

That scenario may sound scary, but it is actually much less severe than it seems at first glance. Today’s actual quarterly active foreclosure number is 74,860. That’s over 7.5x lower than the number of foreclosures the country saw at the peak of the housing crash in 2009. When looking at the graph below, it’s clear that even if the number of quarterly foreclosures today doubles, as ATTOM Data Solutions indicates is a possibility (not a given), they will only reach what historically-speaking is a normalized range, far below what up-ended the housing market roughly 10 years ago.

Equity is growing, jobs are returning, and the economy is slowly recovering, so the perfect storm for a wave of foreclosures that will radically adjust the economy does not appear to be developing and may not be the “crash” many analysts are thinking may happen in the 2021 housing market forecast. As Odeta Kushi, Deputy Chief Economist for First American notes:

“Alone, economic hardship and a lack of equity are each necessary, but not sufficient to trigger a foreclosure. It is only when both conditions exist that a foreclosure becomes a likely outcome.”

While our hearts are with anyone who may end up in foreclosure as a result of this crisis and how it can hit hard in a very personal way, we do know that today’s homeowners have more options than they did 10 years ago. For some, it may mean selling their house and downsizing with that equity, which is a far better outcome than foreclosure.

Bottom Line

Homeowners today have many options to avoid foreclosure, and equity is surely helping to keep a lot of people in a very strong financial position regarding housing. Even if today’s rate of foreclosures does double in the next year, it is still only expected to hit a mark that is more in line with a historically normalized range, and this is a very good sign for homeowners and the 2021 US economy in general.

If you find yourself in an unsteady housing situation, I’m here to help. My team has advisors to help you with anything you may be experiencing. Each person has unique circumstances affecting their housing situation. Even if you are presently renting and may want to consider buying a home, my team and I are here to help.

If you are wondering about your present home value or are considering a move to a new city or state, I’m here to be the best source for information so you can make the right decisions to meet your goals. Check out our home value analysis for the specific possibilities on your home, and check out our recent Market Update for your area to give you a general look at what’s happening in your city. I appreciate you looking us up, and letting us be your information source for anything you may have a question about or need help with. We love people, and we love properties. Just reach out and call us at (503) 799-8354 to get in touch.

Cheers,

Michael Jester

Oregon Licensed Real Estate Broker

My Real Estate Advisor Team

Powered by eXp Realty, LLC

(503) 799-8354 Direct

michaelj@myreateam.com

www.myreateam.com