Thinking of buying your first home?

Buying your first home is a big deal, but how do you know when your dream is not a reality? As with selling a home, buying a home involves solid planning, clear decisions, and good timing.

We help you sort out what needs to be done at every step of the process so you can reach your dream, and enjoy it. We know there are people out there who buy a home thinking it is a dream, but in reality, it became a nightmare. You can rest easy knowing your first home purchase is exactly what you had in mind when you started the home buying process.

The home buying plan requires you to complete some steps to be successful.

- Know what your credit score is by requesting your annual credit report

- Clear up any credit issues revealed on your credit report

- Know what you pay out each month in all areas

- Don’t close bank accounts or credit accounts

- Don’t open bank accounts or credit accounts

- Make down payment money accessible and ready to use

- Know exactly why you are moving

- Meet with a real estate professional to…

- Ask questions and be sure they are a match for your goals

- Talk through the process with your agent

- Build a plan for your first home purchase

- Meet with a lending professional to see how much you qualify for

- Decide how much you actually want to spend on your home purchase

- Pick where you want to move and communicate with your agent on your desires

- Go with your agent to look at casually preview homes

- After each casual visit, define what features you “need” in your first home, and…

- Define what features you “want” in your first home

- Start boxing up things you don’t want to move

- Keep looking at homes in your target area in a relaxed way with your agent to define more of what you need/want in a home

- Have a garage sale or sell things online

- Box up more stuff so you don’t have to work hard on move day

- Start seriously looking with intent to buy your first place

- Put in an offer to purchase your first home

- Go through the contract process (about 30-days in general)

- Finish up the process, and get the keys to your first home

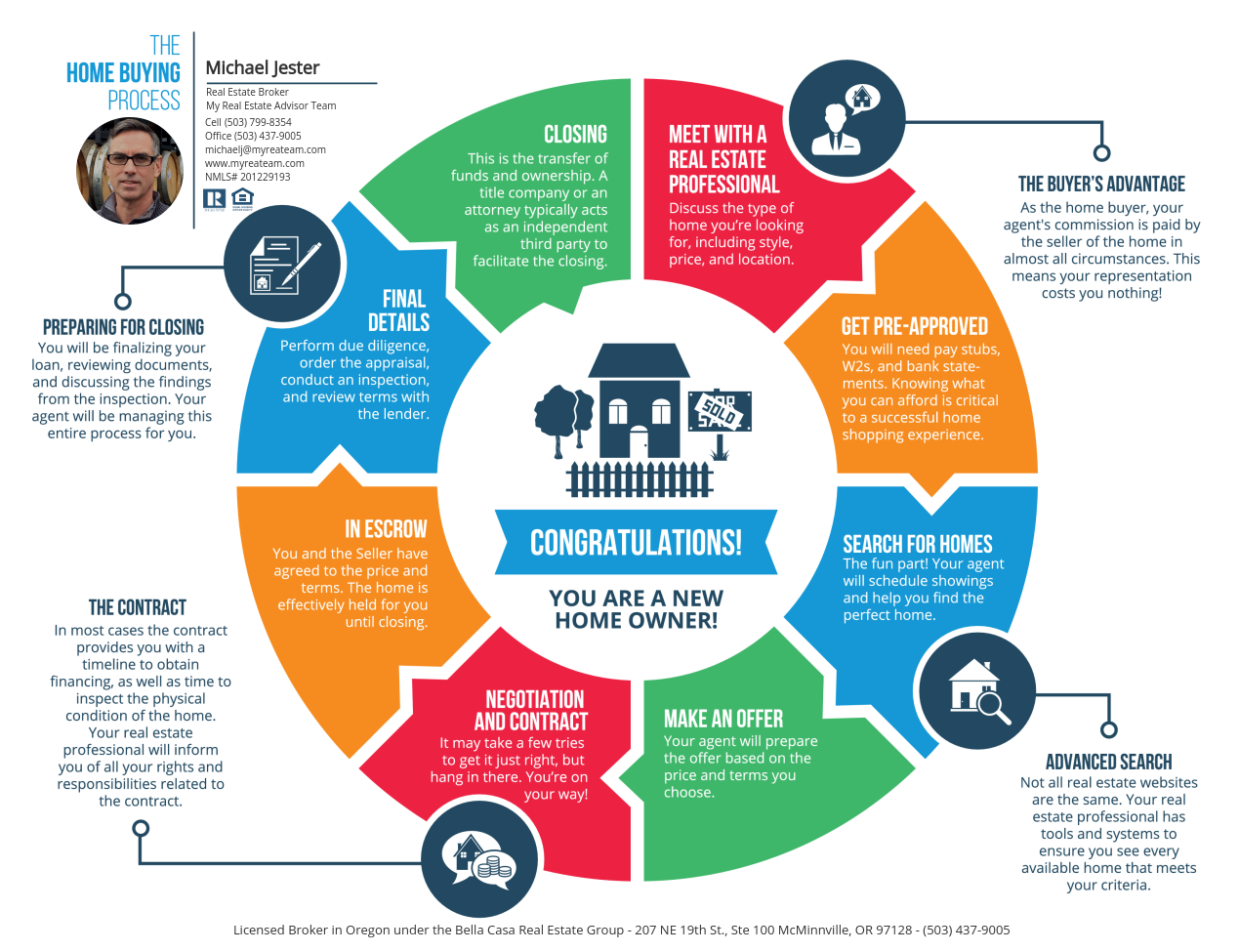

Here is a good chart for the process of buying a home. It is the general flow of what happens once you decide to make an offer to purchase a home. Check it out and you will see how simple the process actually is to complete a sale.

There are always things that happen to complicate the process. You can clear away a lot of the complications by getting pre-approved for your loan as opposed to pre-qualified. A lot of issues happen when funding issues arise that can complicate things on the buyer’s side of a purchase contract. Getting pre-approved lessens the potential of issues with funding during the escrow process.